We devoted a recent episode of the "Economics Out Loud" podcast to personal finance, markets, and the approaching storm. NES graduate and professor at Michigan State University Dmitriy Muravyev talked about the future of the economy, inflation, and how an investor should behave in a crisis.

The global economy has been growing despite the pandemic, but all good things come to an end, and a recession is at the doorstep. It will definitely start, but we do not know when and how deep it will be. The coming crisis is unlikely to be devastating. Today, the US inflation is running at 8%, but in the longer term, it will drop to 3-4%.

Current inflation acceleration worries the markets not only because people are suffering, but also because the central bank is forced to react to rising prices. In theory, the central bank balances unemployment and inflation. The former is relatively low in the US today, while the latter is very high. Therefore, the Fed started raising the interest rate: it was negative in real terms (i.e., below the expected inflation), and at some point, it will become positive.

One more global process that impacts all spheres, including inflation, is deglobalization. If we look, for example, at how an iPhone is made, we understand that it is a product of collaboration between many companies and countries. This allows, firstly, to improve the quality, and secondly, to reduce costs. However, globalization began to collapse even before Covid, and this process was most clearly manifested in the US-China trade conflict.

In theory, the government has three major instruments to influence markets:

- tax rates (this instrument does not produce immediate results);

- through the central bank interest rate;

- through the central bank asset purchases (the so-called quantitative easing). Central banks had to resort to this relatively new instrument because their interest rates were already very close to zero and the Fed could not use the traditional monetary policy mechanism to support the economy and markets.

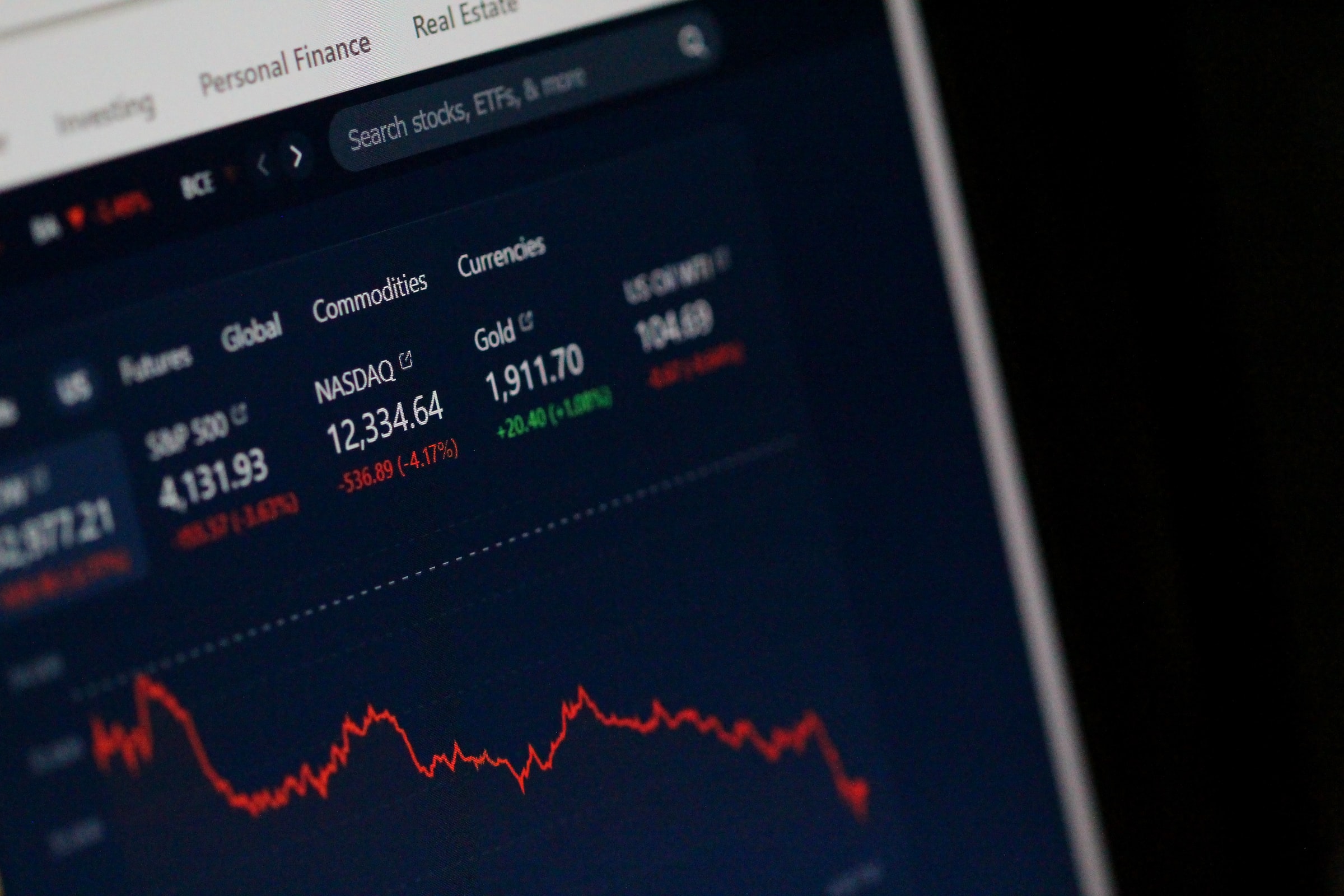

Now the interest rate is no longer at zero, investors expect further increases, and in the future, it will become positive in real terms. The Fed is also moving from quantitative easing to quantitative tightening: it is starting to sell assets from its balance sheet, i.e., withdrawing liquidity from the economy to crack down on inflation. This means that there will be less money in the economy and it will become more expensive. In response, investors start to review their investments and reassess their future returns. If we take a traditional manufacturing company, for example, an iron and steel works, it can make a profit right now, whereas tech startups can only promise future earnings. And when interest rates rise, the technology sector looks much less attractive, so we see a fall in the NASDAQ index and cryptocurrencies, while investing in traditional, boring companies suddenly becomes more attractive.

When I came to Russia (Dmitry lives and works in the US – editor), I discovered three interesting things.

First, foreigners and Russians have completely different views on what is happening in the world right now.

Secondly, it may seem that nothing is happening. Yes, some stores have closed, but if you do not read the news, it feels like nothing has changed. The panic has subsided, the Russian Central Bank and the government managed to avoid it. I expected that there would be bank failures and corporate bankruptcies, but they are also not happening despite the worst recession since the 1990s. And the main surprise is the strengthening of the ruble, although it is quite easy to explain: oil and gas prices are rising, so there is a large influx of US dollars, while there is no growth in demand for them since imports are falling. And this situation is unlikely to change soon.

The outlook for the Russian economy depends on how successfully it adapts to the external constraints that it has faced. A market economy has an intrinsic ability to adapt itself. It took time for Belarusian oysters to appear on the market, and it will take time for airplane parts to appear in the country. New suppliers will take the place of the old ones, but logistics chains will become longer, some products will become more expensive, there will be a shortage of some products, and some of them will be of inferior quality. However, the main problem is total uncertainty.

The third thing that surprised me was how much people talk about America, and how much they are interested in it. Even though Russia is far from being the main topic in the US. Americans are much more interested in the situation in China, because it leads to supply disruptions and price increases in the States and the situation with baby food is a big problem.

The power of the US dollar will, perhaps, decline in the future, but in a very distant one, because there are fundamental trends that make it a global currency. The first one is the network effect: everyone uses it, so I will use it too. The second one is the strength of the American economy. If anything is weakening the role of the dollar, it is deglobalization.

Right now my focus would be more on risk management, because the current task is not to lose, rather than to make money. There are only a few ways to manage risks, and one of them is diversification. I have always been in favor of international diversification because it allowed picking weakly correlated assets. But life has proven to be full of surprises, and it is now unclear what is going to happen to Russian investments in international assets.

Therefore, taking into account the range of instruments still available to Russian investors, national stocks should be part of their portfolio. The choice is not large. There are also real estate and precious metals, but you cannot sell them quickly, and besides, gold is a very volatile asset. Meanwhile, stocks are a liquid class of assets that in the long run show higher returns compared to bonds.

Anyway, stocks should only be a part of the portfolio, as it is a risky asset, a super-risky one nowadays. In a portfolio, they should be balanced by less risky assets, such as bonds. Still, I would be careful with bonds, since there are risks of defaults. Cryptocurrencies can also be part of your portfolio, although, of course, there are great risks associated with them.

Retail investors trade a lot and trade the old trends: they buy when the market is growing and sell when it is falling. As a result, they buy assets at their peak and sell them at their bottom. When some kind of turmoil starts in the market, people start to panic, it seems to them that they urgently need to do something, run somewhere. This causes losses to grow. This was shown during the crisis of 2008 when many retail investors lost their money starting to sell off their assets at the time of the market crash.

Another mistake is poor diversification. An average investor in the US holds 3.5 stocks in his or her portfolio, and many hold just one. It may be the very stock that will shoot through the roof, or, on the contrary, its price may drop to zero. Thus, your portfolio should have different stocks and different asset classes that are not related to each other.

The main recommendation is not to panic, consider different scenarios (for example, what happens if your income drops or you lose your job), make a balanced portfolio and forget about it for a while.

And there is another lesson worth keeping in mind. In the long run, risky assets are more profitable than the low-risk ones, but crises make people who have survived them avoid risk. The generation that grew up during the Great Depression in the United States invested less in the stock market than people born after that crisis. Therefore, it lost in financial terms. This is how the crisis in Russia will also affect the well-being of those who survived it, because these people will avoid risk in the long run.