If we try to trace the origin of Fintech, we shall find that it has existed in some capacity or the other since the first wave of financial globalization during the late 19th and early 20th centuries. Like other technological revolutions of the past, it has been, and continues now, to cause significant structural change: novel technologies in a short time are replacing traditional ones. Some of the most important Fintech innovations were electronic payment systems, web-based business models, and bank digitalization. In this post, we will look into the landscape of the present-day Fintech industry and sectors where start-ups can find big market opportunities for development.

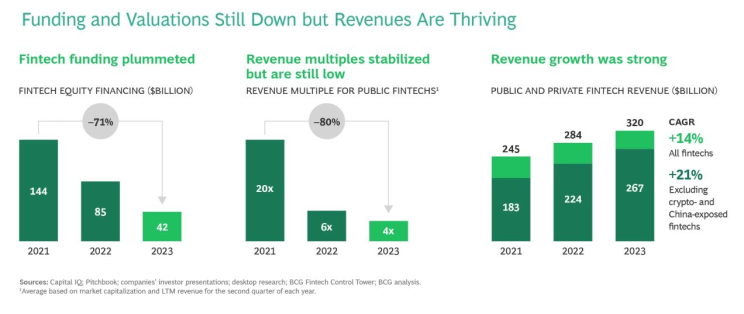

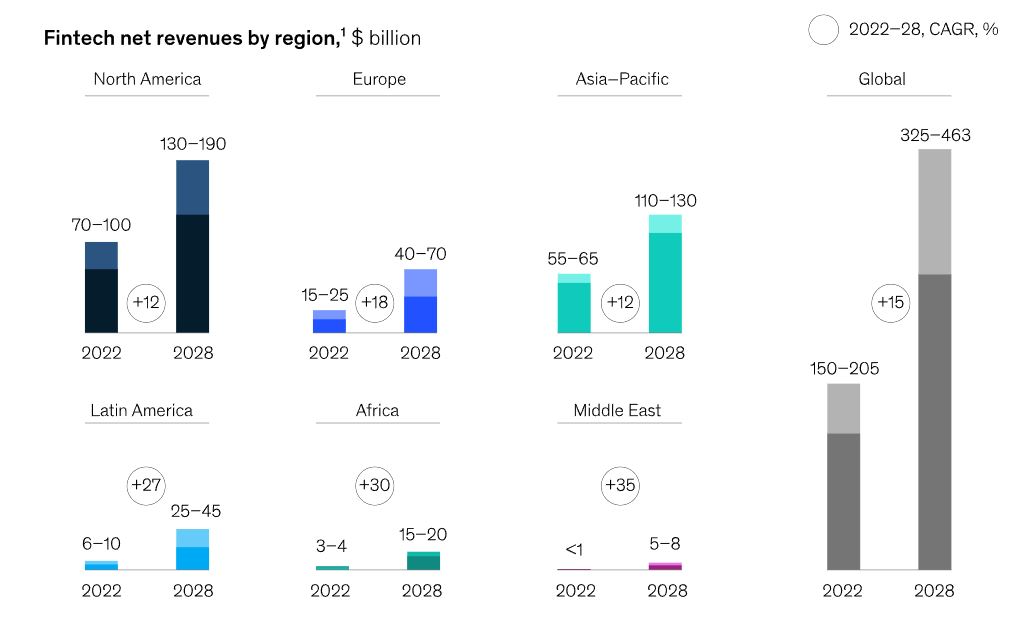

With recent advancements in AI, Blockchain, cloud, and data analytics Fintech has emerged as a disruptive force that is reshaping the global financial landscape and beyond, redefining how both firms and individuals manage, invest, and interact with money. Over the past few years, it has become an industry with global net revenue exceeding $150 billion as of 2023 (representing around 5% of the global banking sector’s net revenue) and is expected to grow to $400 billion by 2028, McKinsey & Company estimated in October 2023. Boston Consulting Group expects the sector to reach a market size of $1.5 trillion in revenue. Unprecedented innovation is creating a fertile ground for start-ups to thrive. The relevant sectors include numerous technologies, software, tools, systems and so on that various institutions in banking, insurance, lending, wealth management, and other segments utilize to operate and provide services to clients.

Yet, as in many other innovative sectors, achieving breakthrough results requires certain funding. Venture capital (VC) plays an important role here. By offering essential finance and expert support, VC firms are empowering Fintech start-ups to scale their concepts, challenge traditional solutions, and introduce innovative products and services in the market. The World Economic Forum and McKinsey have launched a joint initiative Fuelling Innovation: Closing Fintech Funding Gaps to foster and redirect VC funding for Fintech companies across regions and sectors where it is most needed.

Figure 1. Funding and valuations still down but revenues are thriving

In a recent White Paper, Fintech founders, investors and industry experts, surveyed by the World Economic Forum and McKinsey, outlined pathways that can provide a comprehensive approach to developing a supportive Fintech environment, thus creating attractive investment opportunities and identifying high-potential sectors for founders.

One of the sectors is digital public infrastructure (DPI) that can be classified across four core building blocks: identity, payments, data sharing and other emerging technologies (such as geospatial DPI or artificial intelligence models). Among these blocks, payment systems play a crucial role in today’s real-time digital economy, and the development and implementation of DPI in general has the potential to stimulate economic growth, and thus unlocking significant opportunities and funding for start-ups.

Figure 2. Overview of the five pathways to close Fintech funding gaps, based on interviews with key stakeholders

Source: Fuelling Innovation: Closing Fintech Funding Gaps, World Economic Forum and McKinsey & Company

The authors of the report note that the payments subsector continues to secure about 20-25% of Fintech funding, but as other subsectors – such as digital banking, capital markets, banking-as-a-service and embedded finance – become more active, their share has increased notably, reaching around 13% in 2023.

Among other things, the White Paper also calls for enhancing regulatory clarity and encouraging regional collaboration, as well as improving certainty and clarity in regulation and regional regulatory collaboration in order to foster the Fintech industry that could generate an additional $200-280 billion in GDP by 2030, representing an up to 1.4% increase in annual economic output.

The World Economic Forum and McKinsey also advise Fintech start-ups. To succeed, they should concentrate on core strategies driving sustainable growth, and implement disciplined cost management mechanisms and operational adjustments while remaining flexible and nimble. McKinsey & Company research shows that companies that focus on their core business and have a strong home market are 1.6 times more likely to generate peer-beating returns. Those that adopt disruptive technologies such as AI across products and solutions will have a big advantage since the deployment of AI across the banking sector could generate an annual value of $200-340 billion, representing 9% to 15% of operating profits, according to recent estimates. As for the strategic M&A opportunities, founders should carry out a careful evaluation with an emphasis on selecting the right partners and focusing on effective post-deal integration.

Figure 3. VC Fintech funding trends by region (2015 to 2023)

Fintech is one of the most popular industries for NES alumni. Many have become founders and built impressive careers. Two start-ups of NES alumni Nikolay Storonsky (Revolut) and Alex Gerko (XTX Markets) are among the world’s leading Fintech companies.

Fintech-driven transformations have proven to bring positive outcomes, including increased financial inclusion, more cost-effective and streamlined operations, and improved customer satisfaction. But the Fintech Revolution is not just about financial services; it is about transforming lives and economies. Meanwhile, the challenges it creates include data security concerns and the potential for market instability. As the sector continues to evolve, its role in shaping the future of finance is expected to grow even more prominent, opening many more opportunities for entrepreneurs who are ready to develop new products and solutions.

If you want to learn more about Fintech, join our online lecture series at GURU (in Russian).