Robert Solow, the author of the famous model of economic growth and one of the most renowned economists, a student of Nobel laureate Wassily Leontief and a teacher of many Nobel laureates, passed away on December 21, 2023. Konstantin Egorov, a Visiting Professor at the Einaudi Institute for Economics and Finance and NES graduate, recalls his great legacy in a column for GURU. Solow's models were so simple that they do not even need to be simplified to be retold, he notes, and yet modern researchers of growth not only follow in Solow's footsteps, but also work solely with his residual.

Robert Solow was awarded the Nobel Prize for research done back in the 1950s. To be honest, among modern economists, perhaps only historians can recall more than just a few contributions to economic science of that decade. But Solow's model and his way of calculating economic growth are striking exceptions. They are not only still described in modern textbooks in their original form, but are also used in the reports of consulting firms and banks.

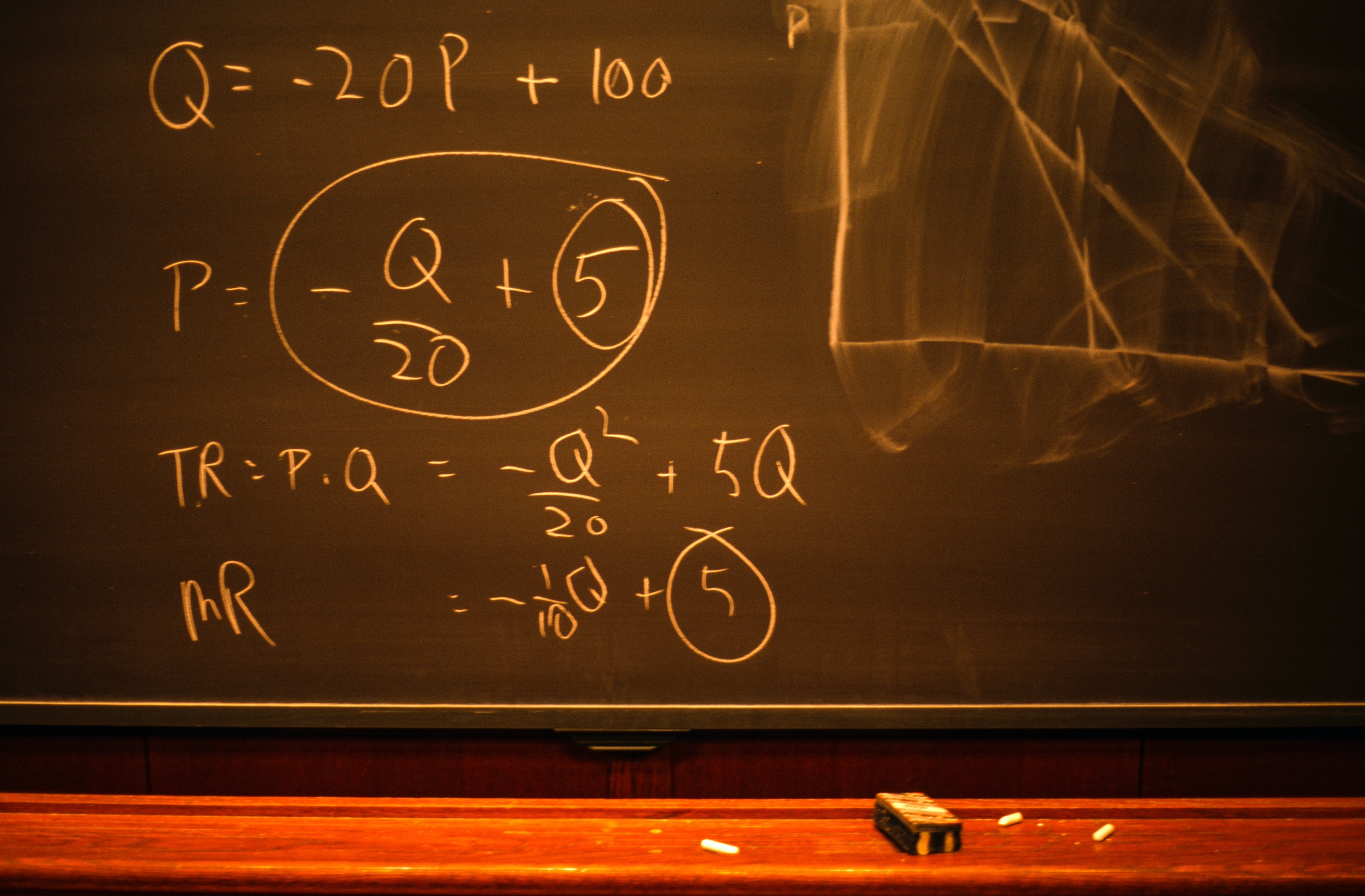

Solow's concept, on the one hand, is so simple that students usually do not take it seriously, seeing for the first time the only (!) equation of his model. On the other hand, it is this model that most often provides the most convincing explanation for those episodes of rapid growth that journalists like to call ‘another economic miracle’ and which they seek to explain with the most hype words and trends of their time.

A similar story has happened many times. In the 1930s, the USSR economy grew at a pace almost unprecedented for the West, while the West itself was literally paralyzed by the Great Depression. Such a vivid contrast convinced many of the superiority of communism over capitalism, and it was often used as an explanation of the growth of the USSR. Similar fears arose in the US in the 1970s, when Americans switched from domestically made cars to cheaper and more convenient Japanese autos. It was almost a humiliation for the nation that the “most powerful” country in the world could not compete even at home with a quite poor country. Moreover, when experts of the time extended the growth rates of the two countries on the charts, it turned out that the GDP of small Japan was supposed to overtake the GDP of huge America by 1998! Of course, in pursuit of explaining the miracle, it was not difficult for journalists to find many confirmations of the superiority of the “Japanese system” – from attention to detail and endless respect for customers to extremely economical use of physical resources, space and time. In the wake of this enthusiasm, apparently, such blockbusters of my childhood as Teenage Mutant Ninja Turtles and even Beverly Hills Ninja appeared.

The growth of all the Asian Tigers and, of course, China in the 2000s caused a similar delight. But in each case the economic miracle ended and growth slowly faded out. Of course, each of these rapidly growing countries, including the USSR, had their unique features and know-how. But, surprisingly, the explanation that Solow gave for Soviet growth in the 1950s worked just as well for other countries mentioned above. Moreover, it predicted that at some point growth should slow down significantly, and it is unlikely that any country will be able to overtake the US in terms of GDP per capita.

Solow's explanation relies on almost the only assumption – decreasing marginal productivity. For example, it is quite difficult for a writer to do without a keyboard. The contribution of the first keyboard to his or her performance will be huge, but the second keyboard will only be used as a spare. And this rule applies not only to capital, but also to many other factors of production. The contribution of the first good idea of a new product to an entrepreneur's business is huge, but most likely, he or she may not have enough time and energy to implement the second good idea. The contribution of the first highly educated engineer at a factory is also huge: most likely, he or she will be able to significantly improve the efficiency of many production processes. But it is obvious to everyone that you do not need to spend money on training all employees to this level.

Solow showed that this concept of diminishing marginal productivity alone is enough to explain the path of a rapidly growing country. As a rule, poor countries are poor in everything: they lack capital, education, ideas, and institutions. As soon as the first factory appeared in a country like the USSR, it, of course, began to earn a lot. These earnings could be used to build a second factory that would earn a little less, but still a lot. The same happens with education. The money earned by improving the efficiency of the first highly qualified specialist can be spent on acquiring the second one, etc. At such moments of early economic growth, it may seem that the bright future of communism is not far off. But, according to the concept of decreasing marginal productivity, the contribution of the last factory or specialist will be about the same as in already rich countries where there are many of either one or the other. And therefore, the “economic miracle” countries are likely to be able to catch up with developed countries, but will not manage to overtake them in their development.

Roughly speaking, Solow's explanation was that the USSR grew rapidly when it lacked the main factors of production: capital, basic literacy, and urban population. This was after the Civil War in the 1930s, and after WWII in the 1950s. As soon as it caught up with other countries in terms of these factors of production, the growth of the USSR slowed down significantly.

But Solow did not just show how the law of diminishing marginal productivity alone can explain catch-up growth. His other and probably even more important contribution is that he was able to use a minimal set of data to assess the extent to which growth is catching-up, which, of course, is of primary importance for predicting the prospects for this development.

Solow's concept is so simple that it hardly needs to be simplified to be retold. If there is data on overall GDP growth and on the growth of individual factors of production, then one can calculate the contribution of each of these factors. In the 1950s, there was data only on the capital-labor ratio, and it was already clear from it that the larger share of Soviet growth was due to capital accumulation, and therefore such growth could not last very long. There is more data now, and, for example, according to a McKinsey report, about half of the Chinese GDP per capita growth in 1990-2016 can be explained by the accumulation of capital and only a very small part of this growth was due to an increase in the quality of the labor force, primarily due to education.

The main problem with this approach is that we do not have data on the most modern and in some sense the most essential and rare factors of production. This share of the overall growth since the 1950s that cannot be explained is commonly referred to as the Solow residual. In other words, this is all the growth that cannot be explained, for example, by accumulation of capital or improving the education of the population. For example, we do not know how to conclusively measure how many good and important ideas have appeared in society over the past year. We cannot understand how much the institutions important for growth have improved or deteriorated. A modern economist would say that after saturation with capital, the main obstacle to growth in the USSR was the lack of other factors of production, such as democratic and market institutions. They were the ones that appeared in Poland in the late 1980s or in China in the late 1970s, allowing these countries to begin developing rapidly.

There is another problem, just as important as the lack of reliable data. In fact, we still have not fully figured out which institutions, ideas, and other factors are really essential for growth. For example, in the 1990s, the world went through massive computerization and the development of information technology. Many believed that it should radically accelerate economic growth, but most estimates agree that the contribution of IT to growth over this period happened to be relatively small.

It turns out that we lack understanding and data on the most interesting and non-trivial growth factors. Thus, researchers have to resort to other methods to understand the causes of growth. For example, a few years ago, a group of scholars estimated how much discrimination against black Americans and women hindered economic growth in the US after 1960. Of course, discrimination is still strong, but while in 1960 94% of all doctors and lawyers were white men, by 2010 the share fell to 62%. Research results show that 20-40% of the total US economic growth over those 50 years can be explained by the fact that more blacks and women managed to get complicated and high-performance jobs. In other words, this growth was achieved at the expense of greater meritocracy in society.

In fact, this case is very illustrative of post-Solow research on economic growth. Scholars are looking for different ways to assess the contribution of those factors for which we do not have direct data. After all, it would be strange to come up with complex and difficult-to-verify reasons for growth if almost all of it could be explained by the simplest and most obvious reason, the reason that was already explained by Solow. Therefore, all modern scholars who study growth not only follow in Solow's footsteps, but also work solely with his residual.