Behavioral economics has made a great contribution, first, to prove that culture is among the factors that do matter when it comes to decision-making and, second, to study the mechanism behind this impact. In this respect, the Cultural Dimensions Theory created in 1980 by Dutch management researcher Geert Hofstede has introduced new dimensions and perspectives to research. In this post we will not only discuss the theory but will also look into how culture impacts economic behavior of firms and individuals.

Hofstede based his theory on an extensive survey during the 1960s and 1970s, investigating variations in values within different sectors of IBM covering over 100,000 employees from 50 countries across three regions. The Cultural Dimensions Theory shows and helps understand the effects of a society's culture on the values of its members, and how these values relate to business and economic relations. Hofstede's model includes six key dimensions for comparing national cultures: the Power Distance Index, Individualism vs. Collectivism, Masculinity vs. Femininity, the Uncertainty Avoidance Index, Long-Term vs. Short-Term Orientation, and Indulgence vs. Restraint.

In a recent paper National Culture's Influence on Firm Performance in Bad Times: Evidence from the Covid-19 Crisis and Gfc, a group of scholars applied Hofstede’s framework to analyze the role of national culture for firms in the COVID-19 economic crisis and 2007-2009 global financial crisis. Using cross-country, firm-level data from 55 countries, they found that firms from countries possessing the cultural attributes of long-term orientation, strong uncertainty avoidance, or low individualism are associated with lower downside risk and stronger profitability, and thus they were less affected by both crises than their counterparts. Moreover, the authors argue that the impact of national culture is smaller for large firms, potentially due to the diverse background in their management team, i.e. a mixed cultural background.

Jedrzej Pawel Bialkowski and Moritz Wagner from University of Canterbury together with Laura T. Starks from University of Texas at Austin suggest in their paper Cultural Values and Cross-Country Differences in Responsible Investing Sectors that cultural norms appear to be important determinants for responsible investment (RI) fund industry development and size. Based on data from 25 countries, the scholars conducted analyses to explain the diverse sizes of the responsible investment industry through a combination of cultural, economic and environmental variables. They also employed Hofstede cultural dimensions and found that the RI sector is larger in countries with higher scores on individualism, femininity, and long-term orientation. For example, measures that reflect an emphasis on caring, solidarity, and cooperation are positively related to the adoption of RI funds and are robust across different fund categories, they note.

Bialkowski and co-authors write that, if many of a country’s investors’ primary motivations are driven by societal values, then the adoption of certain strategies is affected by the cultural norms under which those investors live. They also demonstrate that individuals’ investment choices can be driven by common personal experiences in a society, in particular when it is responsible investing, also termed environmental, social and governance (ESG) investing with regard to the environment.

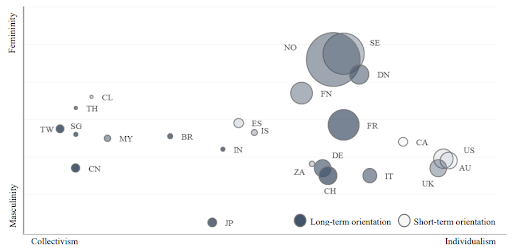

Figure 1. Hofstede’s cultural dimensions and the size of the responsible investment sector as percent of total net assets

Note: the figure plots the cross-section of 24 countries along three cultural dimensions of Hofstede: individualism vs. collectivism (x-axis), masculinity vs. femininity (y-axis) and long-term orientation (blue-grey) vs. short-term orientation (light-grey). The size of the circles represents the size of the RI sector in each country as percent of total mutual fund assets. Source: Cultural Values and Cross-Country Differences in Responsible Investing Sectors.

NES President and Full Professor of Economics Shlomo Weber who studies such aspects of culture as language and religion says that they significantly impact our economic behavior. For instance, Confucian culture has facilitated a more rapid economic development in societies upholding its values, and Protestant countries remain among the richest in the world, although their leadership position has become less apparent over time. When it comes to certain nations, South Korea, also is an interesting example of the relationship between unique culture and economic development. It was discussed in an episode of the “Economics out Loud” podcast due to the fact that over the past half century, it has become the only developing country with a medium or large population that has been able to increase per capita income to the level of developed countries.

The element of culture can stand behind economic differences even within one country. The case of the northern and southern regions of Italy was discussed during one of the sessions at NES Popular Science Days in memory of Gur Ofer with NES Academic Director Ruben Enikolopov.

Culture also plays a big role in shaping institutions that, in turn, determine countries’ prosperity. Daron Acemoglu, Simon Johnson and James Robinson won the 2024 Prize in Economic Sciences in Memory of Alfred Nobel for showing that societies with a poor rule of law and institutions that exploit the population do not generate growth or change for the better. Thus, research shows that culture drives economic performance, impacts firms’ and individuals’ economic behavior, and can help avoid certain risks during economic crises.